The stock market was no place to be during much of July and into the first week of August.

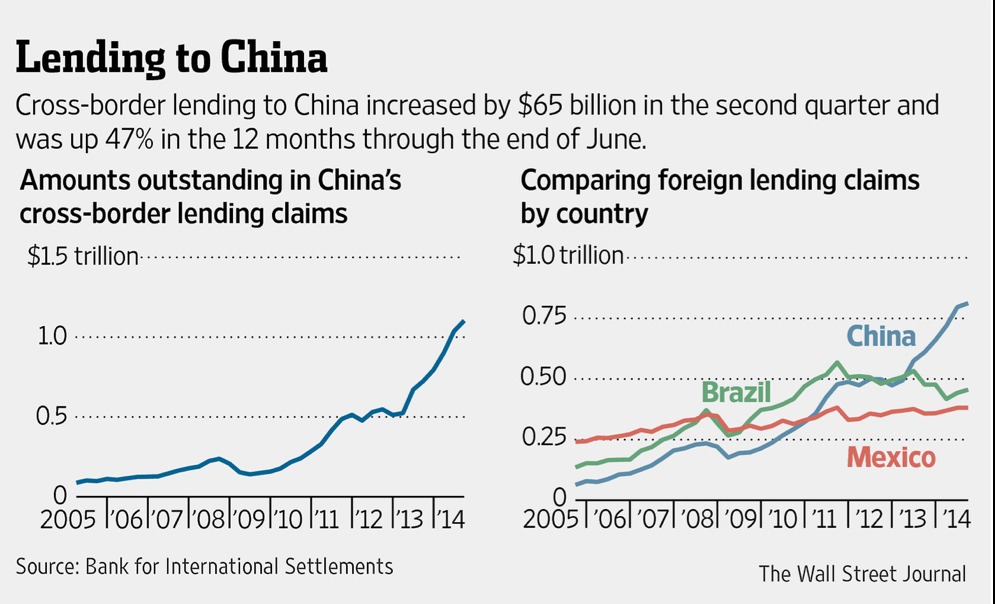

Whether it was the never-ending story of the Greek Financial Crisis, the virtual collapse of the Chinese stock market or the continuing threat of a first Fed rate hike, the markets didn’t like any of it.

I have never been very good at timing the market. In fact few investors are.

Selling Pressure

Maybe I am too much of a fan of Jim Cramer who famously has said: “There is always a bull market somewhere.”

This time maybe not so much.

In any case, many of my long-time winners started breaking down during the past six weeks.

Lineup Changes

In the Growth and Momentum portfolio, I ended up parting company with Avago (AVGO), Disney (DIS), Texas Instruments (TXN), the Interpublic Group (IPG), and NXP Semiconductors (NXPI).

These are all great companies in my opinion and I am sure I shall be revisiting at least some of these in the future.

As these stocks broke down, I tried with mixed success at replacing them with new names.

Portfolio Additions

Celgene (CELG), although a biotech, came and went. Gildan (GIL) came and went.

But some new names came into the portfolio and hopefully they will hold up under the selling pressure of a correction, should one come.

These include Accenture (ACN), Fortinet (FTNTO), Intuitive Surgical (ISRG), Newell Rubbermaid (NWL), O’Reilley Automotive (ORLY), Coca-Cola (KO), Visa (V), and Under Armour (UA).

Outlook

They represent different investment themes and hopefully will work out in the portfolio.

Going forward, I plan to continue to respond to market changes, reposition, seek to limit my losses, and look for opportunities.

The investments discussed are held in client accounts as of August 17, 2015. These investments may or may not be currently held in client accounts. The reader should not assume that any investments identified were or will be profitable or that any investment recommendations or investment decisions we make in the future will be profitable.

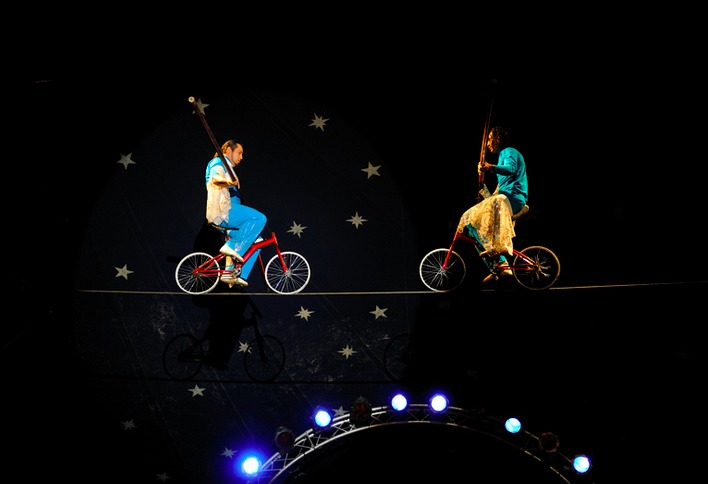

Photo Credit: Dirkjan Ranzjin via Flickr Creative Commons