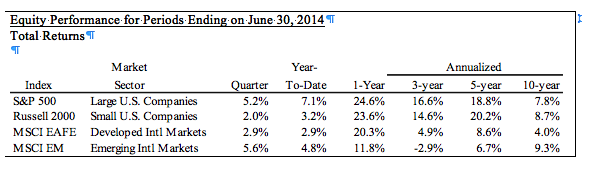

The S&P 500 Index (SPX) closed on June 30, 2014 at an all-time high, posting total returns of 5.2% for the second quarter. It was the sixth consecutive positive quarter for the S&P 500.

The stock market’s advance during the quarter was remarkably steady, especially considering a fair amount of negative news. The market showed almost no reaction to the renewed fighting in Iraq, ongoing tensions between Ukraine and Russia, rising energy prices, and weak economic data such as the surprising 2.9% decline in U.S. GDP during the first quarter.

Market volatility, as measured by the VIX index, dropped to its lowest level since early 2007, indicating that investors see market risk as low. However, many market observers view low volatility as an indicator of investor complacency and regard it as a warning sign of a possible market correction.

In late June, the government reported that 2014 first quarter gross domestic product declined by 2.9%. It was the first quarterly decline in three years and the largest drop since the first quarter of 2009. Many analysts attributed weak GDP to the impact of harsh winter weather and expect stronger performance for the remainder of 2014. Other economic statistics were mixed.

The unemployment rate declined to 6.1%, its lowest level since September 2008. However, job growth has been anemic during this recovery and much of the decline in the unemployment rate has been attributed to individuals leaving the labor force.

The labor force participation rate is now 62.8%, down from 66.4% in early 2007. On a positive note, the Conference Board Leading Economic Index rose in May for the fourth consecutive month, hopefully predicting improvement from the first quarter’s weakness.

At the end of June, the S&P 500 Index was trading at 16.2 times its estimated earnings for the next 12 months, roughly 15% higher than its 10-year average. The current higher valuation might be justified when considering the low interest rate environment, which gives stocks an advantage over fixed income investments.

However, it should also be regarded as a warning indicator that stocks are no longer inexpensive, and that there is potential downside should interest rates rise or corporate earnings growth fall short of expectations.

During the second quarter, demand for bonds increased producing strong performance and causing interest rates to continue their decline. The Barclays Aggregate Bond Index, the broadest benchmark of the U.S. bond market, generated returns of 2.1% for the second quarter of 2014. The yield on the 10-year Treasury bond decreased from 2.72% at the end of March to 2.52% on June 30.

While the increase in stock prices implies investors expect an improving economy and a low risk environment, the decline in Treasury yields suggests an opposite opinion – that the economy is sluggish and risk is increasing. (Yields go down when Treasury bond prices increase. Higher Treasury bond prices reflect a flight to safety by investors when they perceive an increase in risk.)

Thus, if economic growth picks up as expected by stock investors, the bond market is likely to correct as interest rates rise. Alternatively, if economic growth remains weak as expected by bond investors, the stock market could be in for a correction.

Over long periods of time, stock prices move higher as corporate earnings increase. In the past two years stock prices have increased at a much greater rate than earnings. During this period, the S&P 500 has produced returns of 50.3%, while earnings have grown just 13.2%.

This disproportionate increase in stock prices can be attributed to a number of factors. Investors’ confidence has improved significantly as the 2008-9 market crash and the Great Recession fade from their memory. Alternative investments, such as fixed income securities, offer low returns compared to equities.

In addition, the Federal Reserve’s stimulus program has likely contributed to stock performance in my opinion. Now that stock prices are much higher, the next leg of the bull market may likely be more dependent on stronger earnings growth to support higher valuations. Considering the recent performance of stocks reflects a fairly high degree of optimism with little room for disappointment, it is probably best to have modest expectations for near-term market performance.

DISCLAIMER: The information in this material is not intended to be personalized financial advice and should not be solely relied on for making financial decisions. Past performance is no guarantee of future results.