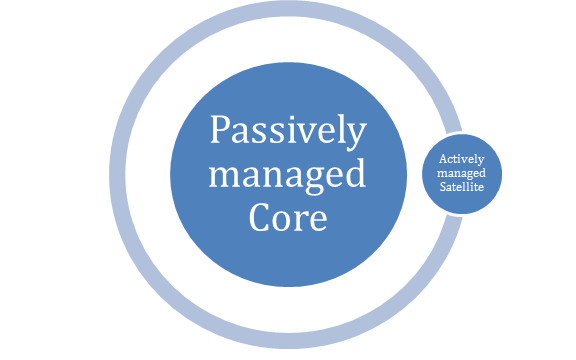

Core-satellite is a popular approach to investing that typically combines low-cost index portfolios with actively managed funds in an attempt to outperform the market.

Yet most investors using this strategy have too much flab in the core of their portfolio, says Ronald Surz, president of PPCA Inc.

Surz manages the Centric Core portfolio on the Covestor platform.

He thinks Centric Core portfolio can be a better strategy than using an S&P 500 index fund, for example, in the core portion of a core-satellite approach.

“Low-cost indexing reduces overall portfolio costs, but the S&P 500 also reduces performance by diluting active manager returns, so the net result is frequently lower after-fee performance,” Surz said.

Centric Core portfolio aims to hold roughly 45 large-cap U.S. stocks that are not classified as either growth or value in major benchmarks like the S&P 500. Value investors generally look for bargains, or stocks that are undervalued based on price-to-earnings ratios or other metrics. On the other hand, growth companies are those that are expected to increase their revenues at a rapid pace.

Surz’s goal is to hold middle-of-the road stocks that can be ignored by both growth and value managers.

Specifically, Centric Core is designed to complement active managers in the satellite component of the core-satellite tactic.

“I believe if you use an S&P 500 index fund for the core, it brings unwanted baggage with a lot of growth and value stocks,” Surz said. “I’m focusing on the fuzzy stuff in the U.S. large-cap market that falls between growth and value. The bottom line is I don’t want overlap with active managers. I don’t want to dilute their investment decisions.”

So the portfolio is a replacement for the S&P 500 as the core and can result in better performance and diversification in a core-satellite approach, he added.

“The S&P 500 is the whole apple. My portfolio is just the core,” Surz said.

“Centric Core can work better with active managers,” the portfolio manager notes. “The ‘magic’ in those 45 core stocks is in their ability to increase the performance and enhance the diversification of multi-manager investment portfolios. Think of it as salt or seasoning – not very tasty on its own, but it brings out the best in many foods. Centric Core does not compete with the other managers on Covestor — it completes them.”

Core-satellite image source: CFA Institute

DISCLAIMER: The information in this material is not intended to be personalized financial advice and should not be solely relied on for making financial decisions. All investments involve risk and various investment strategies will not always be profitable. Past performance is no guarantee of future results.