Forget headlines for a second. Yes, we know that the U.S. Federal Reserve will stop the latest round of quantitative easing (QE3) at one point and that they are terribly behind the curve if one applies the Taylor rule. We know that most of Europe is a mess.

We know that Japan and China have huge demographic problems. Forget headlines because this is a bull market. It is hard to argue with that: the S&P 500 (SPX) will probably have a positive 2013 after rallying in 2009, 2010 and 2012.

Bull markets experience different stages – denial, acceptance, optimism and euphoria. I believe that US stocks are in the middle of a late stage bull market, where general sentiment can be characterized as optimistic but not euphoric. That’s not a bad thing: historically, stocks gained the most during the first and the last stage of the bull cycle, so the best might be yet to come.

In a late stage, the crowd has widely accepted that stocks are indeed in a bull market and retail money moves off the sidelines. So it doesn’t surprise that “investors are on track to plow the most money into stock funds since the technology bubble burst in 2000”, an October headline on CNN Money.

Improving economic conditions are another characteristic of the optimism phase. Markets are forward looking, so economic numbers usually do not improve during early stages. Take the recent ISM reading for example, which came in better than expected.

On the other side, we don’t see signs of euphoria yet. There is simply no “the sky is the limit” feel to the markets. Once your grandma starts arguing why you should buy stocks, you should get concerned. Valuations were elevated last July, according to Mark Hulbert, but not ridiculously high.

There is no talk about why “it is different this time” to justify high stock prices. However, not all bull markets reach the euphoria phase, so one has to look out for warning signs. Below, I’ll discuss two emerging red flags.

Fed-induced liquidity has been a big driver in the last years and the committee is still pumping $85 billion dollars into the financial system each month. The money somehow finds its way to equities. Research has shown that during times of “permanent open market operations” (POMO), equities tend to do well. This is the reason, why I’m reluctant to short stocks. Don’t fight the Fed.

The biggest issue for stocks these days is declining breadth. I have been writing about deteriorating equities participation earlier, but the phenomenon started to present itself on longer time frames and is reason for concern.

In fact, a pattern that we have seen some years ago has emerged: chart 1 displays the percentage of S&P 500 stocks that trade above their 200 day moving average.

Back in May 2007, the S&P 500 was still recording new highs, but fewer stocks traded above the 200 day. In other words: fewer stocks participated in the rally and eventually, the entire market broke down. The same divergence developed during summer this year.

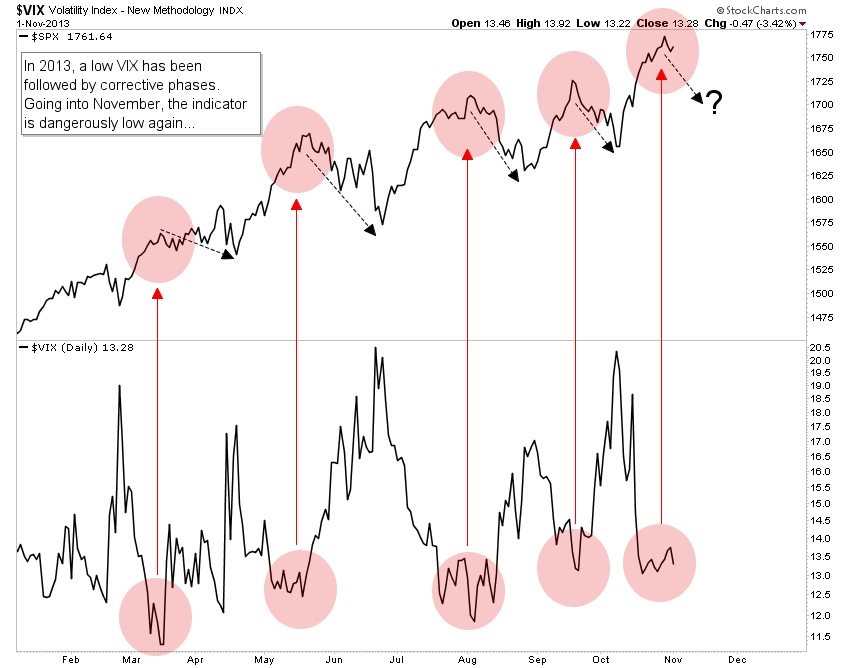

A more short term concerning development is the current VIX level. The VIX is often referred to as the “fear indicator” and measures implied options volatility. When the VIX is high, fear of market participants is considered high and vice versa. As can be seen on chart 2 below, the best time to buy stocks in 2013 was when investors were afraid and the VIX traded above 20.

Chart 1: fewer stocks are trading above their 200 day moving average.

Caution was warranted when investors became complacent and the indicator traded below or around 13, which is the reading going into November. The indicator suggests that at least a mild pullback is likely.

Chart 2: In 2013, a low VIX has been followed by lower equity prices.

In summary, I’m leaning towards the long side since the general trend is up. I would get more aggressive if stocks should consolidate. Breadth divergence is a concern and I keep monitoring the development.

* * *

Get to know Michael:

DISCLAIMER: Certain information contained in this presentation is based upon forward-looking statements, information and opinions, including descriptions of anticipated market changes and expectations of future activity. The manager believes that such statements, information and opinions are based upon reasonable estimates and assumptions. However, forward-looking statements, information and opinions are inherently uncertain and actual events or results may differ materially from those reflected in the forward-looking statements. Therefore, undue reliance should not be placed on such forward-looking statements, information and opinions.