Alas, the screen is inoperative

There’s more positive news on the housing front, courtesy of online real estate site Zillow (Z). Mortgage rates for 30-year fixed loans quoted on the Zillow Mortgage Marketplace hit a record low of 3.16% on December 4, down 3.2% over the previous week.

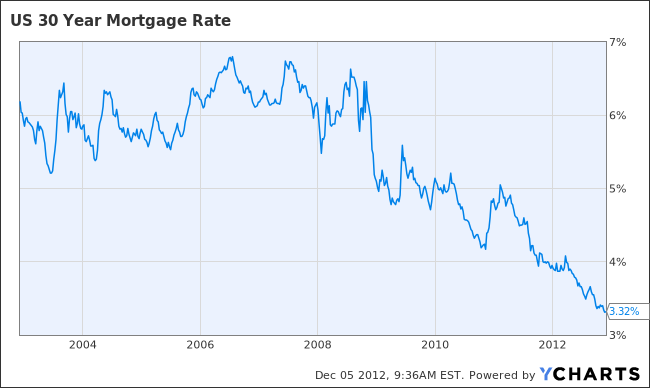

Though the Zillow number reflects price quotes between potential borrowers and lenders – rather than official mortgage rates as reported by Freddie Mac – it’s a reflection of just how far home loan interest rates have fallen. The official rates aren’t that far off, with 30-year home loans going for 3.32% on average as of Nov. 29:

US 30 Year Mortgage Rate data by YCharts

There’s just one problem: While rates have fallen to historically low levels, banks aren’t necessarily in a mood to lend. In fact, lenders are requiring higher credit scores and bigger down payments. In a Nov. 15 speech, Fed Chairman Ben Bernanke cited tight lending practices as a potential headwind for the recovering housing market.

And more trouble could be on the way in 2013 when new rules on banks take effect. First off, banks will need to hold more of their risky mortgages on their own books rather than offload them to other investors. On top of that, new capital standards mandated in the international Basel III accords begin to take effect next year.

It would be a shame if tight credit turned off the lights on the housing party just as it was getting started. The S&P/Case Shiller index of property values increased 3.6% in September compared with the year-ago period. What’s more, prices are up 7% through the first nine month of 2012. That’s the best performance since 2005.

Still, as Bernanke pointed out in mid-November, home prices are below pre-crisis levels, and about 20 percent of borrowers are holding mortgages that are larger than their homes are worth. In 2005, residential investment accounted for 6.3% of GDP; today, that’s only 2.5%.

With banks reluctant to lend to all but the most creditworthy, the Fed seems sure to keep the money spigots open in 2013. The Fed plans to buy $40 billion a month in mortgage-backed securities in its third round of so-called quantitative easing. That’s pushed mortgage rates to the basement, but a full-fledged housing recovery will still need the banks to loosen up on home loans.

Image: Editor Tupp