Apple (AAPL) is readying a new China offensive to reignite growth in a region where it’s far from the undisputed market leader. Apple recently announced that the Wi-Fi version of the iPad mini and fourth-generation iPad with Retina display will be available in China on Dec. 7, and the iPhone 5 will be available in China the week after.

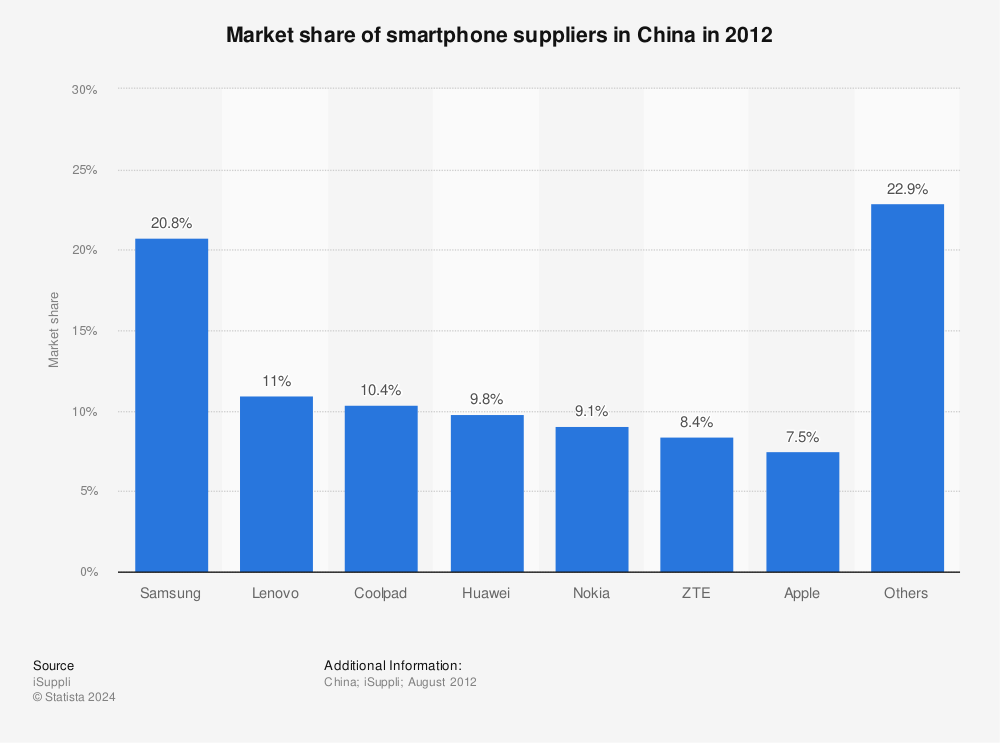

The arrival of the latest iPhone in the world’s No. 2 economy is welcome news for Apple, which has struggled there in the high-end mobile phone market. In China, it’s Samsung, not Apple, that rules. In the competitive smartphone space, Apple is No. 7 with a 7.5% share of the market as of August, according to IHS iSuppli.

Samung Electronics (SSNLF), whose phones run on Google’s Android software, is the market leader with 20%. Chinese players such as Lenovo (LNVGY), Coolpad, Huawei (CN:002502), ZTE (CN: 000063) and Nokia (NOK) also best Apple in this market.

Apple is wildly popular in China – but its iPhones can cost close to $800, out of the reach of most Chinese families. “The sweet spot of affordability in China is 800-1,500 yuan ($130-$240),” Michael Clendenin, managing director of Shanghai-based consultancy RedTech Advisors, told Reuters earlier this year. Hence, the thriving black market for the iPhone5 and all manner of Apple gadgets that are smuggled in from Hong Kong.

In the lower cost tablet market, Apple’s position is far stronger on the mainland, where it enjoys a 70%-plus share – light years ahead of Lenovo.