by Michael Tarsala

Bullish investor sentiment has nearly doubled in the past month, and is now above historical levels, according to the latest AAII investment sentiment survey.

It’s one signal that the strong market rally may be starting to run out of gas.

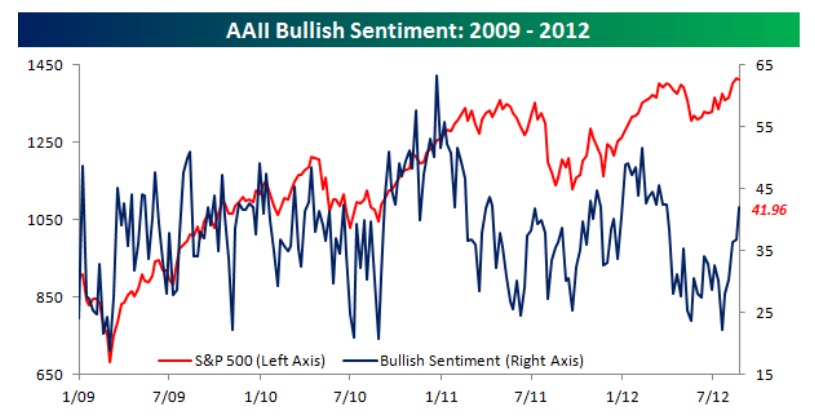

The following chart from Bespoke Investments is the level of bullish sentiment.

Source: Bespoke Investments, AAII

Just five weeks ago, you can see that it reached nearly a two-year low, with 22.9% of survey respondents bullish on U.S. stocks. It reflected an extreme level of market fear. With the idea of buying when others are fearful, we had written at the time that this pessimism could help send the S&P 500 back into the 1400s.

The S&P has indeed rallied into the 1400s in recent weeks. Yet as a result, the level of bullishness has changed dramatically; nearly 42% of respondents are now bullish, which is now above the long-term average of 39%.

It is not to be interpreted as an immediate market sell signal, but it is one of several signs that investors are getting more greedy and less fearful.

Another concern is the very low level of market volatility. There is a perception that the market is risky right now ahead of U.S. elections, concerns about Europe and China’s economies, and the coming U.S. fiscal cliff.

When it comes down to it, though, investor confidence is arguably at its highest level since 2007. It’s so high that investors may have become too complacent and susceptible to unforeseen market shocks.

Are you prepared for the potential for more market volatility going forward?

Talk to us at Covestor, and we can help you find strategies tailored to your goals, and even help you find investment models that have beaten the market with less volatility than the S&P 500.

If you would like to learn more, call us at 866-825-3005 X 703 in our New York office.

Invest with us, and your money is held in a top-tier brokerage account bearing your name, separate from everyone else’s money. It’s not sloshing around in a big pool run by us or some third party, and there is no one earning interest on it.

You can see the balance change on a daily basis, make investment changes extremely quickly, and add to or pull your money at your complete discretion.