Author: Joseph Ollis, Everyday Capital

Author: Joseph Ollis, Everyday Capital

Covestor portfolio: Everyday Portfolio

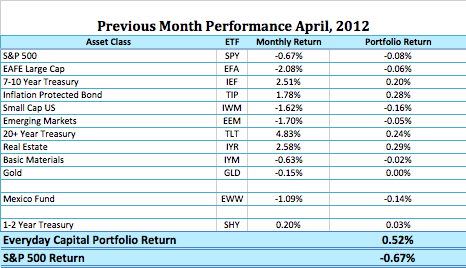

As you see below, the Everyday Portfolio outperformed the S&P 500 this month due to its overweighting of less volatile assets.

*Note: Optimal returns mean no trade friction and no trade commission. Real world results will be slightly higher or lower due to slippage.

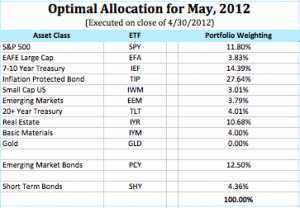

For the month of May, the model’s goal continues to be to hold around 50% in less volatile, fixed income assets and 50% in equities.

The ‘high-beta’ position is emerging market debt which continues to climb higher.

I mentioned in the beginning of the year that the portfolio is starting to increase exposure to equity as volatility lowered suggesting a bullish move. The market indeed rocketed ahead on low volatility.

I mentioned in the beginning of the year that the portfolio is starting to increase exposure to equity as volatility lowered suggesting a bullish move. The market indeed rocketed ahead on low volatility.

Though the portfolio underperformed the market as it rallied higher, it still managed to capture a portion of the gain. It is up over 2% on the year. The best part of this move is that the 2% was captured with incredibly low daily volatility, which is the intention of the portfolio strategy.

Interestingly, the volatility of the market has increased in the last few weeks as everybody saw a bearish head-and-shoulders pattern emerge. This put people on edge and enabled the market to again move higher as people were out of position.

The portfolio shifted some from equities back to less volatile assets for the month of May. It is taking a bigger position in TIPS as well as intermediate treasuries.

This tells me that the market is in for consolidation of its recent run up.

Regardless, the Everyday Portfolio is doing what it should – making it easier to sleep at night.

If you’re tired of volatile returns with your passive “buy and hold” portfolio, join us at Covestor where we trade the Everyday Portfolio live and you can follow along!