Register for TODAY’S Next Invest conference now!

By Michael Tarsala

The “S” word — stagflation — is making its way back into investment conversations, with oil prices on the rise and the economy transitioning to being led by the private sector instead of stimulus.

It’s a familiar term to anyone who lived through the disco era, and one that no investor wants to see used again in common parlance.

Just this week, Richard Madigan, chief investment officer, global access portfolios at J.P Morgan Prvate bank, had this to say on CNBC about the transitioning economy:

If there isn’t enough confidence from the private sector, this breaks down and the debate we may be having is stagflation.

Investor Jim Rogers voiced similar concerns back in October, which were soon squelched by the equity market rally.

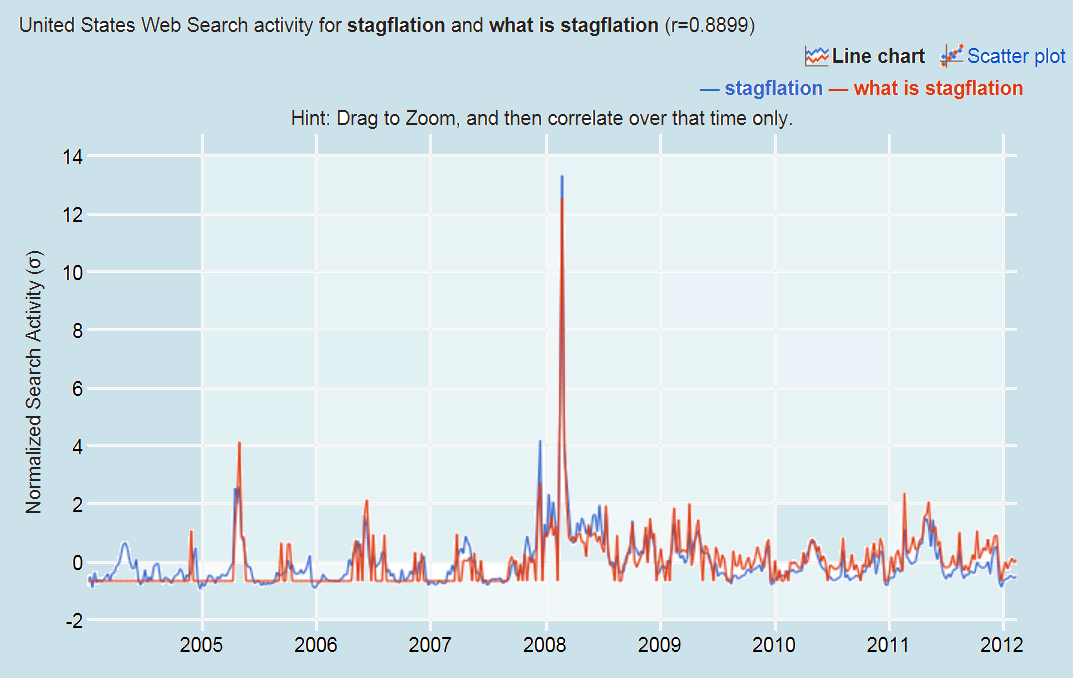

Source: Google Correlate

In the chart above, you see lines representing the popularity of two Google search terms: “stagflation” and “what is stagflation”. You’ll note that the stagflation discussion peaked in early 2008, ahead of the stock market, with falling GDP and stubbornly high oil prices. Those fears receded with the price of crude.

And now, a combination of higher oil and economic threats potentially on the horizon has stagflation talk coming back from the dead.

So what’s the worry?

Stagflation, of course, is a combination of slow growth, stagnant wages and commodity price inflation that ripples through the economy. It was at is peak when the Shah fell, oil supply was cut off, and global oil prices surged in the late 1970s. The result was a crippling combination of higher prices, lower corporate profits and surging unemployment. In terms of investments, it led to commodities outperforming stocks.

To workers, stagflation can look like long unemployment lines. If it had a taste, it would be government cheese.

Conceptually, it aint’ pretty, either. It looks something like this:

Source: The Market Oracle

Next Invest participants weigh in

I have talked to several market experts ahead of the free Next Invest virtual conference on March 20 and 21 about the potential for future stagflation — or at least rising inflation. While no one voiced loud concerns about stagflation’s full-blown return, several raised similar caution flags to one the nonpartisan Milken Institute did this week regarding higher energy prices slowing the economy.

Of note, NextInvest guest Christopher Henwood, former VP at Goldman affiliate J. Aron, told me he sees $5 gas by the summer.

Other guests expected to attend include David Whitmore, senior strategist at ETrade; Lee Hull, founder of Hull Capital Management and author, “Less Risk, More Return”; Tadas Viskanta, editor of Abnormal Returns; Howard Lindzon, CEO of Stocktwits; Brian Bolan, equity strategist at Zacks.com; and Patrick O’Hare, chief market analyst at Briefing.com.

Positive economic trends persist, but there is future uncertainty regarding all four stagflation factors.

In addition to the energy-led inflation worries, future GDP and employment growth are both tied largely to the private sector’s ability to grow on its own. As Madigan pointed out, that remains unclear.

Meanwhile, corporate earnings may be at future risk.

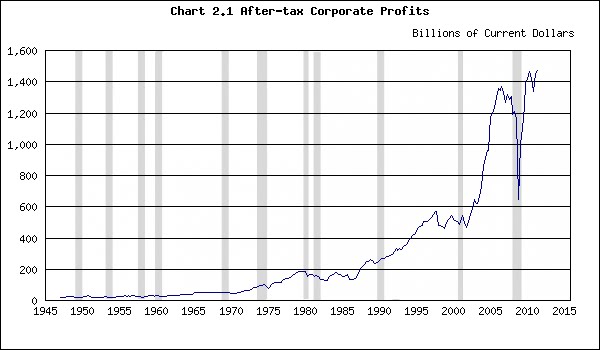

Source: http://beyourowneconomist.blogspot.com/

As you can see from the chart above, they are at historic highs when measured in terms of after-tax profit, largely a function of companies cutting to the bone in the recession. It is not clear how long those historically high margins will last.

One additional threat to stocks is a possible long-term rise in Treasury yields, which could increase their attractiveness relative to equities.

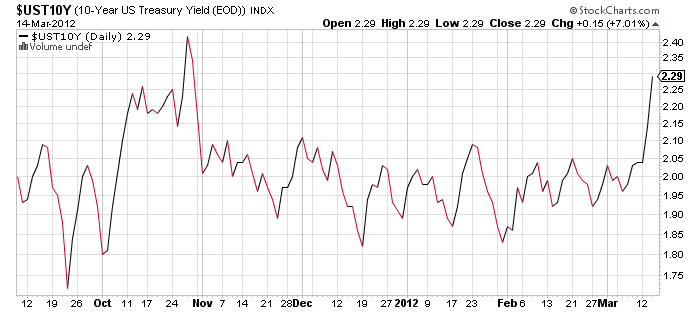

Source: Stockcharts.com

I asked some of the Next Invest experts, could the benchmark 10-year yield see a reversion to the mean, which could in turn help deflate stock markets?

“I think it definitely will,” said Next Invest participant Bill DeShurko, President of 401 Advisor. “It’s just got to happen, based on the idea that the economy actually recovers enough to sustain higher interest rates. And will that hurt stocks? Yeah. It’s going to hurt your PE ratios. … We’re going to face a different world if interest rates start going up. And you’re going to have to be pretty nimble to make money in that environment.”

Time to think about coming changes?

Some are raising suggestions about getting more defensive. Robert Arnott, Pimco fund manager and chairman of Research Affiliates, was on MarketWatch this week, discussing how both bonds and stocks crumble in the face of inflation. He spoke of the need for a “third pillar” that won’t fall. He said that could include TIPS, commodities, and emerging market stocks.

For that reason, some of the important NEXT invest topics will include MLPs and modeled energy portfolios and ways for the individual investor to attain broad commodity exposure. The conference also will address quant and technical strategies that move differently from the S&P 500, as well as emerging market models and funds.

I will be there, and I hope you will be, as well. Registration is still open for the free online event.