Author: Barry Randall, Crabtree Asset Management

Author: Barry Randall, Crabtree Asset Management

Covestor model: Crabtree Technology

Disclosure: No positions in stocks mentioned

Pop quiz: Which is the tech stock, Dell (DELL) or 3M (MMM)?

Crazy question, right? I mean, Dell is a tech bellwether and has been for 25 years, selling products loaded with microprocessors and running software, powering the cloud and serving Web 2.0 apps.

Meanwhile, 3M sells, what? Post-it Notes? Scotch Tape? Kitchen Scrubbers? Is 3M a tech stock? Get real.

Well, exactly. The reality is that Dell is a supplier of industrial equipment. It spends about 1% of revenue on research and development. It has just under 5,000 patents issued or applied-for. Its PCs and servers long ago became commodities, what the typewriter and the telephone were 40 years ago.

And 3M? It is an innovation powerhouse. It spends 5% of annual revenue on research and development. It has over 40,000 patents issued or applied-for. Every year it turns out dozens of new products, developed by in-house talent.

So should we suddenly feel sorry for 3M? I mean, here they are, loaded with scientists and researchers, vigorously swirling beakers, mixing raw Unobtanium with triple-distilled nanocubes of Ungodlium, and selling the resulting Polyrazzmatazz worldwide… and their CEO probably would be turned away by Il Fornaio’s maitre’d in favor of some Stanford undergrad with $100,000 from some third-tier Valley angel. 3M’s CEO should just change his name to Rodney Dangerfield.

Anyway, why should investors even care? 3M is run by grown-ups. And while being headquartered in the technology Siberia of Saint Paul, Minnesota makes their judgment suspect, heck, all those Bunsen burners will keep them warm.

But we should care because technology stocks make up the single biggest (17.5%) sector in the S&P 500… so getting tech wrong has outsized consequences for both professional and individual investors. If we don’t even have a stock correctly categorized, we take the risk of not getting the returns we hope for when we invest in tech.

The appeal of investing in technology is simple: find companies that are commercializing innovative products, because those products are likely to be unique… and therefore rare… and therefore without competition… and therefore without pricing pressure… and therefore more profitable. And sales of those products are growing more quickly than those of the incumbent products being replaced.

And this is exactly why 3M is more of a tech company than Dell: 3M’s gross profit margins are consistently in the 45-50% range, two and a half times as large as Dell’s 18-20% gross margins. This is directly attributable to 3M’s strategic commitment to innovation.

So now that we’ve re-established the intrinsic appeal of tech companies, let’s view some of today’s more famous names through this prism:

- Intel (INTC): Definitely a real tech company, with lots of applied high-technology and the margins and leadership to go with it;

- Microsoft (MSFT): The Redmond behemoth thinks it’s a player, but most of its R&D is dedicated to refining the big moneymakers, Windows and Office. After 20 years of spending 10-15% of its revenue on R&D, it finally has a winner: Kinect. This pathetically low batting average is absolutely related to the fact that shares of Microsoft have gone nowhere for 10 years (except for the dividends). Microsoft has great gross margins, but it’s not achieving them while profitably taking share in new markets. There’s a reason why Microsoft is in the Dow Jones Industrial Average…

- Google (GOOG): From the sophisticated algorithms powering its search engine, to the holistic architectures (power, thermal, processing) of its data centers, Google has been innovation-driven. Unfortunately, that’s now over, as it straps Motorola Mobility to its back, raising its headcount by 38% with a money-losing, share-losing, trailing-edge technology…loser. Let’s check back later on this hybrid.

- Amazon (AMZN): A giant retailer that applies technology, rather than commercializes it. Yes, they’re taking share from the offline world, but not because of something they invented in the back room. It’s because they’re willing to operate on mere 2% net profit margins, and have no shortage of victims like Barnes and Noble and Best Buy on which to feast.

In short, some of these famous “tech” companies aren’t exactly innovative powerhouses. But they have learned to exploit other aspects of their business model (e.g. Amazon’s sheer scale) to make it work for them.

And what about newer companies attempting to benefit from the halo of “tech” without actually having to don a lab coat and calibrate their electron microscopes? It’s the same thing: some, like Groupon (GRPN), are quickly laid bare as tech poseurs, with valuations compressing until they reach… the same level as every other marketing services company, which is what Groupon actually is.

And some, like LinkedIn (LNKD), will continue to succeed as a business, and command a tech-like P/E multiple, by exploiting the bought-and-paid-for internet with a near-monopoly on professional networking and career management.

In other words, investing in tech requires that you discover what may or may not be “tech” about a company and then ask yourself if it matters.

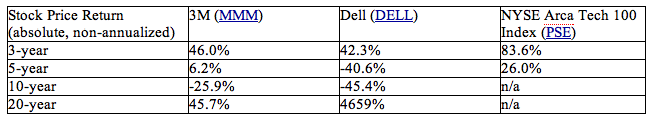

So in the end, what has 3M being more “tech” than Dell meant to shareholders of each?

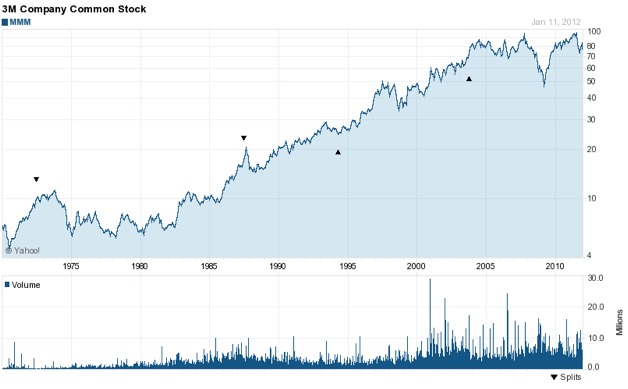

Yes, that’s Dell up 46-fold in 20 years…but all that growth occurred early in its life. Right now, at around $16/share, Dell is trading at the same price as it was in January 1998. 3M is up 84% during that same time frame. And none of these returns include 3M’s dividends, paid steadily since at least 1992 and currently amounting to a 2.8% yield.

The moral: take advantage of the inconsistency in tech stock identification. Look for companies with tech attributes (converting R&D into consistently high gross margins) but with lower, non-tech valuations. Professional technology fund investors can’t stray too far from “tech,” and as a result are forced to own famous yet chronically under-achieving dogs like Microsoft, Cisco and Dell. But individual investors don’t have those limitations. And as a reminder of how real innovation pays off, print out this chart and put it up where you can see it. Use Scotch Tape.