Author: Michael Arold

Author: Michael Arold

Covestor model: Technical Swing

Disclosures: Short EWI

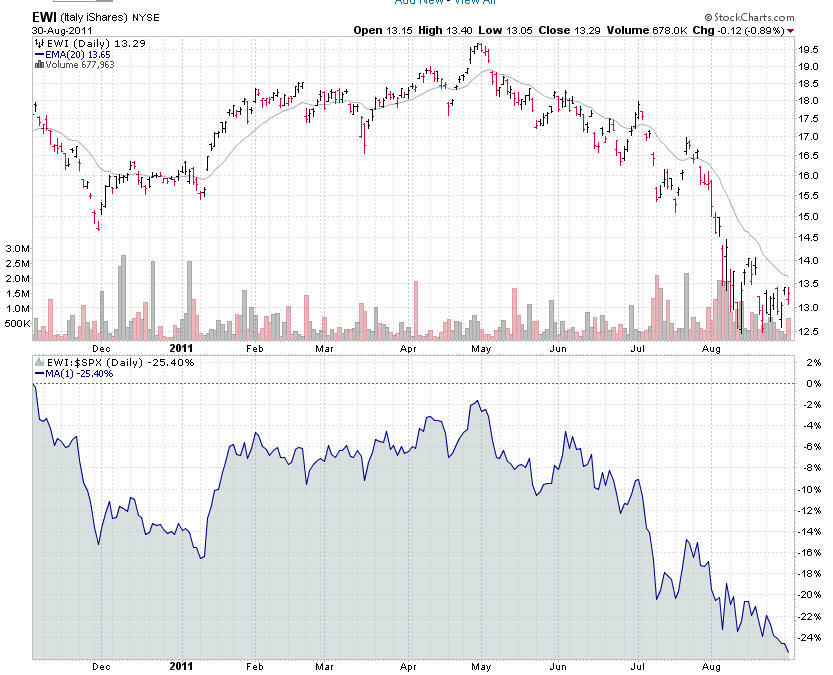

Even though I’m short-term bullish as of 8/31/11 (see my last post), I have a close eye on Europe. One of the positions in the Covestor model portfolio is a short trade of the Italy ETF EWI, even though I accumulated various long positions in US stocks during the last week.

Europe has the potential to kill the QE3-hope-rally in my opinion. As usual, I’m looking at relative strength against the S&P 500 and Italy doesn’t look too good in this respect. In fact, the ETF didn’t participate in the recent rally at all (click chart to enlarge):

Source: StockCharts.com 8/30/11 http://stockcharts.com/h-sc/ui?s=EWI&p=D&yr=1&mn=0&dy=0&id=p90062273859

Unfortunately, Germany hasn’t traded any better:

Source: StockCharts.com 8/3/11 http://stockcharts.com/h-sc/ui?s=EWG&p=D&yr=1&mn=0&dy=0&id=p01879460158

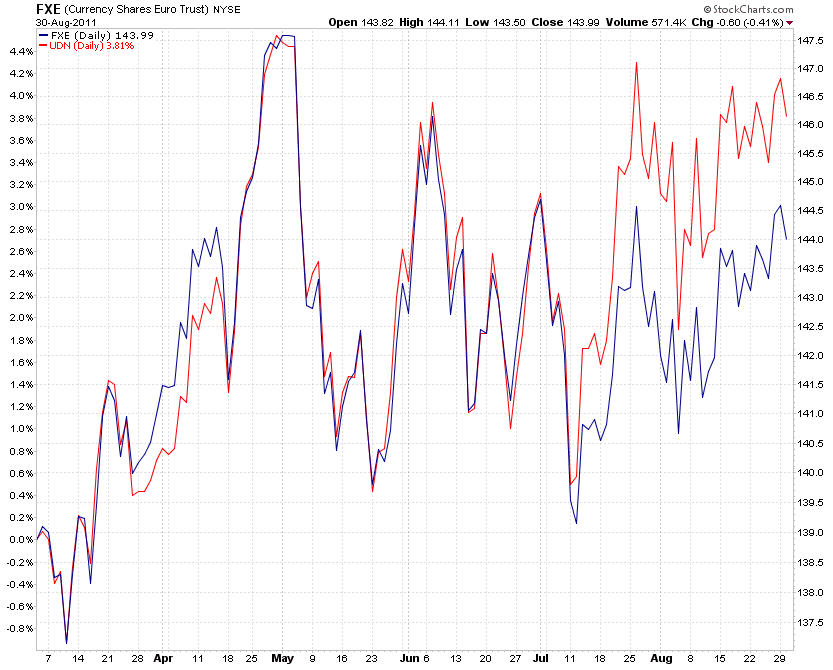

What really doesn’t fit the picture here is the performance of the Euro, which held up quite well in recent weeks. George Soros speculated recently about a “secret buyer” of the currency. The question however is if we are seeing Euro strength or Dollar weakness. The later might be the case, as here’s the FXE (Euro) vs. the UDN (PowerShares US Dollar Index Bearish) from 4/1/11 to 8/26/11- click to enlarge:

Source: StockCharts.com, 8/31/11 http://stockcharts.com/h-sc/ui?s=FXE&p=D&yr=0&mn=8&dy=0&id=p57358262318

Overall, I’m planning to stay short Italy until I see some relative price strength.

Sources:

“What the Lessons from the 2000 – 2003 Bear Market Mean Today” Michael Arold, 8/31/11 http://www.michaelarold.com/2011/08/what-lessons-from-2000-2003-bear-market.html

Soros speculation: “Der Spiegel Interview with George Soros” John Mauldin, 8/14/11 Ritholtz.com http://www.ritholtz.com/blog/2011/08/der-spiegel-interview-with-george-soros/