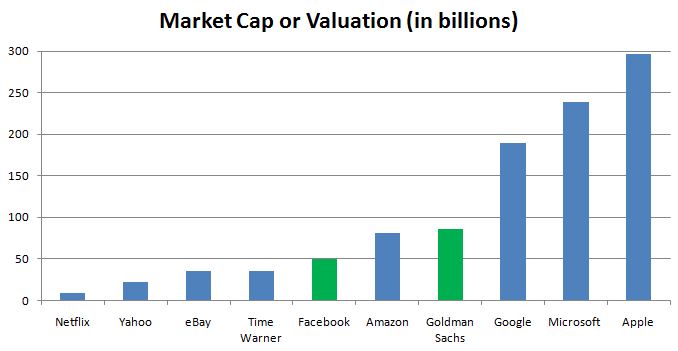

NYT’s DealBook broke the story: Goldman Invests in Facebook at $50 Billion Valuation

Data: Google Finance 1/3/11 premarket, as of 12/31/10 price and shares outstanding

Dan Frommer, BI: “Goldman Sachs got a little extra: It’s now in the driver’s seat to eventually take Facebook public. Beyond whatever it makes on its investment, the fees will be a great bonus.”

Ben Parr, Mashable: “The first thing Facebook’s likely to do with its $2 billion in new funding is to cash out some of its existing investors and employees…Once that’s done, it’s all about growth. We’ve heard from a reliable source that Facebook is close to purchasing the Sun Microsystems campus in Menlo Park, California from Oracle Corporation… Facebook is also likely to greatly ramp up its hiring. Currently the company has between 1,500 and 2,000 employees, a small number compared to its 500 million users and definitely small for a company with a $50 billion valuation… The new round of funding could be the beginning of Facebook’s expansion into other markets as well.”

Staci Kramer, PaidContent: “the structure suggests an IPO isn’t coming right away… It’s one thing to compare market caps to gauge how high Apple and Google have soared. But as long as Facebook stays out of the real stock market, its value hasn’t met the same tests.”

Felix Salmon: “only two years ago, when Microsoft bought into Facebook at a $15 billion valuation, that sum was described in the NYT as ‘astronomical’… [Goldman has] become the only investment bank which can give its rich-people clients a coveted pre-IPO stake in Facebook: the extra cachet that brings and the possible extra clients, make this investment a no-brainer.”

Robert Scoble: “I told Zuckerberg to sell at a $15 billion valuation. Why? I had watched other companies, like PointCast, turn down offers to sell and face doom. But, Zuckerberg and Lorenzen had real vision and I didn’t.”

MG Siegler, Techcrunch: “If [Goldman’s ‘special purpose vehicle’] doesn’t piss the SEC off too much, that is huge for the firm.” Tweet: “At what point did we stop wondering when Google was going to buy Facebook? And when do we start wondering when Facebook will buy Google? I’m kidding, of course. Kind of.”

Howard Lindzon: “Goldman could give a rat’s ass about the social web and sharing. If they are the top in social web, it’s small potatoes. The war in bonds, currencies and commodities is where the real money is at. This is play money. I hate that Facebook is letting them in.. I think that Google has to buy Twitter.”

Kerry Dolan, Forbes: “It should.. make the Winklevoss twins think twice about appealing their settlement with Facebook.”

Yo Yo Trader: “At 86.27 multiple like $CRM [Salesforce.com] and an estimated revenue of $2 Billion… Facebook’s valuation would be $172,540,000,000.”

Albert Wenger: “These deals should really be a wake-up call to politicians and regulators. They are a great example of how well-intentioned regulations can backfire. The net result of the Wall Street research settlement, SARBOX and other protections for small investors has been: small investors now have no access to the most interesting investment opportunities.”