Did September disappoint as that month is historically prone to do?

The answer depends on your perspective. It disappointed by earning nothing, but it delighted by not losing its historical average of -0.7%.

Resilient Rally

As we began the year, many thought the seven-year rally had ended, but not so. Stock market investors breathed a sigh of relief in the first quarter as January losses were more than recovered in March, although foreign markets declined 3% in the quarter.

Continuing into the second quarter, the S&P 500 earned another 2.5%, but EAFE lost another 1%. Then in the most recent quarter, the U.S. market earned 3.5% and foreign markets rebounded 6%.

It would seem that the scare is over, or it could be that we’re whistling past the graveyard being set up for an even bigger fall.

Diversification

Bucking a five-year trend, diversification has finally worked in the first nine months, with gold, real estate, foreign bonds and commodities performing quite well, better than stocks.

This fact has a material impact on multi-asset portfolios, especially target date funds, as discussed in the next section where we introduce a new index.

As for perspectives, the benefits of diversification are not always realized even though theory seems to suggest otherwise.

US Stocks

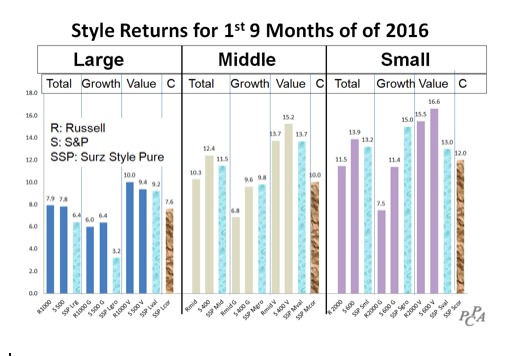

Despite popular opinion to the contrary, style indexes are not created equal, so the following graph shows the popular S&P and Russell style indexes, plus a precursor to Morningstar style boxes called Surz Style Pure® indexes.

Core, defined as the stocks in the middle between value and growth, adds an important perspective; it is to style what mid-cap is to size. Core is shown as “C” in the graph.

Small and mid-cap value stocks have led the way this year so far. The huge appetite for fundamental indexing (Smart Beta) could be the reason for this success.

Smart beta indexes tilt toward smaller company value stocks.

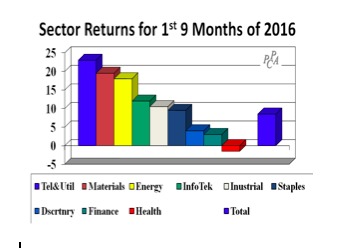

The performance range across sectors is even larger than the range across styles. Telephone-and-utility companies earned a substantial 23% return, while healthcare firms lost 1%.

That’s a 24% spread. Energy prices rebounded in the second quarter, so energy investors have enjoyed a positive 18% return for the year to date, as have investors in materials companies. Tech and industrials round out the list of sectors that have outperformed the broad market.

Photo Credit: wewiorka_wagner via Flickr Creative Commons